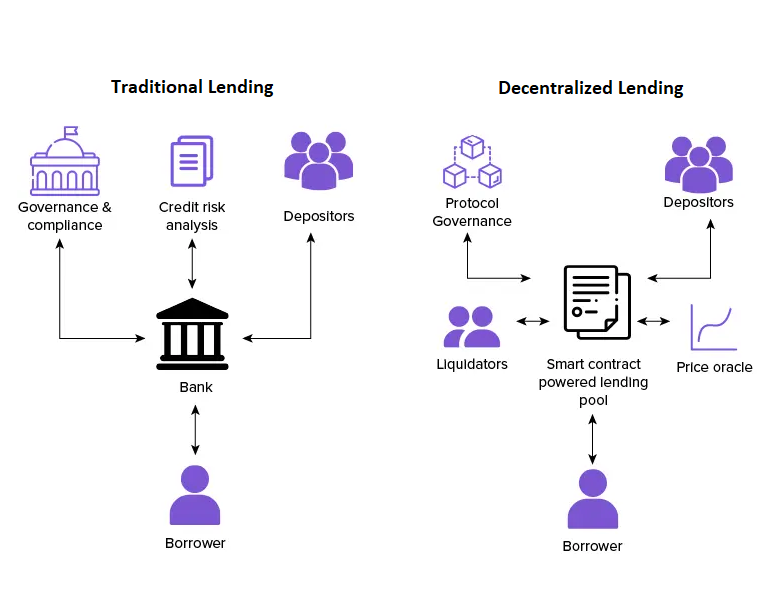

Traditional lending has long been dominated by big banks and financial institutions, but the rise of blockchain technology has opened doors to a new era of decentralized lending platforms. These platforms leverage the power of smart contracts and blockchain to create a lending ecosystem that is transparent, secure, and accessible to everyone.

1. Smart Contract-based Lending

Decentralized lending platforms operate on blockchain networks, like Ethereum or Binance Smart Chain, where smart contracts come into play. Smart contracts are digital agreements that automatically execute when certain conditions are met. In the case of lending platforms, smart contracts also define the terms and conditions of loans. Borrowers interact directly with these contracts to request loans. The lenders review and fund loans by interacting with the same contracts. This also eliminates the need for intermediaries, making the lending process more efficient and transparent.

2. Collateralized Loans

Decentralized lending platforms require borrowers to provide collateral to secure their loans. Collateral can be in the form of digital assets, such as cryptocurrencies or tokens. Borrowers deposit their collateral into smart contracts, which hold it securely until the loan is cleared. If a borrower fails to repay the loan, the smart contract also automatically liquidates the collateral and compensates the lender. This collateralization mechanism also reduces the risk for lenders and ensures that loans are backed by tangible assets.

Decentralized Interest Rates and Liquidity

Decentralized lending platforms have innovative ways of determining interest rates and ensuring liquidity. In a decentralized lending platform, algorithmic calculations determine the interest rates based on the supply and demand of funds within the platform. Borrowers and lenders also actively engage in a decentralized marketplace, where market conditions dynamically set the interest rates. This approach ensures that interest rates remain competitive and responsive to the prevailing market dynamics. To ensure liquidity, automated market makers (AMMs) play a crucial role. These AMMs also enable users to contribute funds to liquidity pools, which borrowers can then access to obtain loans. This mechanism ensures a constant supply of funds and competitive interest rates.

Governance and Community Involvement

Decentralized lending platforms emphasize community involvement and governance. Platform users often have voting rights based on holding native tokens. They can also actively participate in decision-making processes related to platform upgrades, fee structures, and risk management strategies. This community-driven approach also ensures that the platform evolves based on the consensus and needs of its users. Voting can take place directly on the blockchain or through off-chain governance models, depending on the platform’s design.

How do the Decentralized Lending Platforms work?

Decentralized lending platforms operate on blockchain networks and utilize smart contracts to facilitate lending activities. These platforms allow borrowers to request loans by interacting directly with the smart contracts. Borrowers provide collateral in the form of digital assets, which is held in secure smart contracts as a guarantee for lenders. The smart contracts automatically enforce loan terms, including repayment schedules and collateral management. Lenders can review loan requests and choose to fund loans based on their preferences.

After lenders fund a loan, borrowers also receive the loan amount directly into their wallets, and the smart contract records the repayment terms. Borrowers then initiate regular repayments, including both principal and interest, which the smart contract automatically processes. This streamlined process ensures efficient and transparent loan management, eliminating the need for manual intervention or intermediaries. In case of default, the smart contract also triggers the liquidation of collateral to compensate the lenders. This trustless and automated process also eliminates the need for intermediaries, reduces counterparty risk, and promotes transparency and efficiency in lending transactions.

Looking ahead, decentralized lending platforms have the potential to revolutionize the financial industry. By providing transparent, secure, and inclusive lending services, they empower individuals and communities to access credit and participate in the global economy. As the technology matures and regulatory frameworks evolve, decentralized lending will likely become a mainstream option, attracting a broader range of users and institutions. Continued innovation and collaboration will drive the growth of these platforms, paving the way for a decentralized and democratized financial future.

Our Services

At Genesis Convergence, we specialize in providing comprehensive development and consultancy services for decentralized lending platforms. With our extensive expertise in blockchain technology and smart contract development, we possess the necessary skills and knowledge to help clients construct resilient and secure lending platforms.

Our team of experienced developers and consultants work closely with clients to understand their specific requirements and tailor solutions that align with their business goals. Whether it’s creating smart contracts, implementing collateralization mechanisms, designing interest rate algorithms, or ensuring regulatory compliance, we offer end-to-end support throughout the development lifecycle. With our focus on innovation, transparency, and cutting-edge technology, Genesis Convergence is your trusted partner for creating decentralized lending platforms that redefine the future of finance.